Do not rule out a repeat of eurozone crisis

Quite unlikely? Sure. But a repeat of eurozone sovereign debt crisis is not impossible. Averting crisis always requires that politicians plays ball, which cannot be assured.

Eurozone sovereign debt markets have a fun week behind them, with Macron’s early election call leading to nice blowout in French spreads, and some sympathy moves in other countries’ spreads.

This fun revived a discussion about whether eurozone sovereign debt crisis could come back, with some people forcefully pushing back on this view. I sit somewhere in between the doomsters, who see debt crisis coming, and the it-can’t-happen-anymore camp, and here is why.

What caused the last one?

Of course, if we want to know if something will happen again, then a good starting point is figuring out why it happen the first time around. So why did eurozone sovereign debt crisis happen in 2010-2012? Good luck on finding consensus answer to that one… Rather than trying to find agreement, I think it is important to go over the different views out there, as they explain why people think it will or will not happen again.

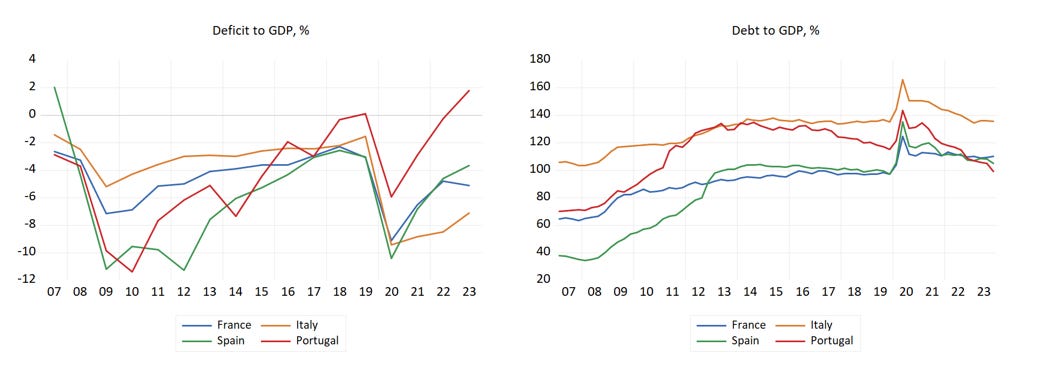

The people who see another crisis coming mostly believe that the first one was all about the fiscal sustainability: debt rose too high, deficits were too large and markets correctly got spooked. And on this basis of course there is a reason to worry: while deficits are mostly better with exception of Italy, the debt levels much worse. Moreover, interest rates are significantly higher than in last decade, so that interest payments will be increasing rather than decreasing as back then. Overall, fiscal situation looks at least as bad as in 2010, even though we are not talking Greece-level situation despite the now-infamous quote from senior EU official.

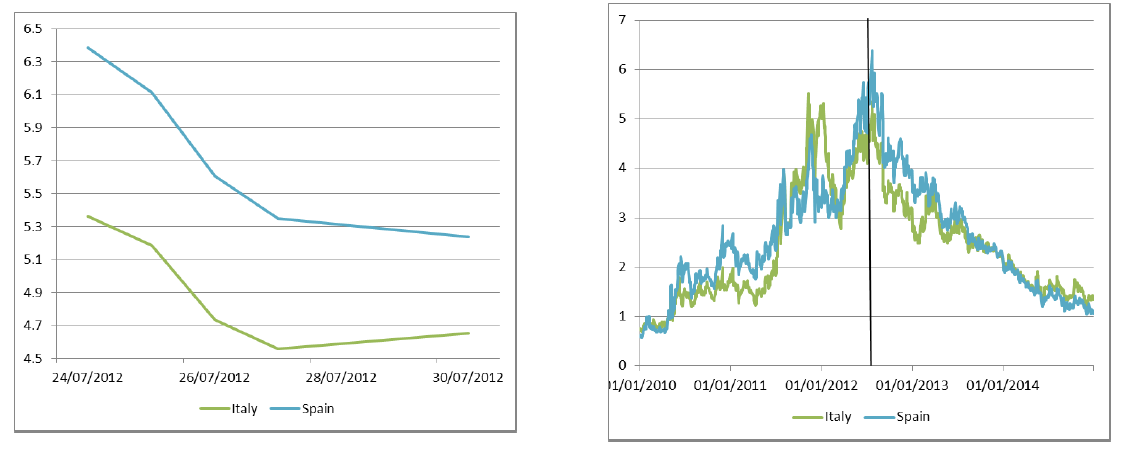

Of course this view focusing on fiscal situation has to contend with the simple fact that the eurozone sovereign debt crisis pretty much ended when Draghi said “whatever it takes” and ECB created OMT program. There was no dramatic improvement in fiscal situation in summer of 2022, nor were there any news about future fiscal outlook in form of stricter rules on future deficits which could be perceived as ensuring sustainability-enhancing actions in the future. It is really hard to argue that it was something else than the simple statement backed by never-used program what turned the crisis around.

Another way of saying this is that all that was missing was monetary backstop; once that was established there was no longer a reason to worry about sovereign debt in eurozone, because investors knew that ECB will step in if things get out of hand. In this view, any current blowout in spreads is just a panic move to be reversed in not so distant future.[1]

Apart from monetary backstop, there are other reasons why things are better this time around. The fiscally vulnerable countries were not running large current account balances over last decade that would need to be corrected. And it is unlikely that there would be same aggressive push towards quick decrease in deficits like there was last time. Both of these played their (potentially significant) role in the last crisis.

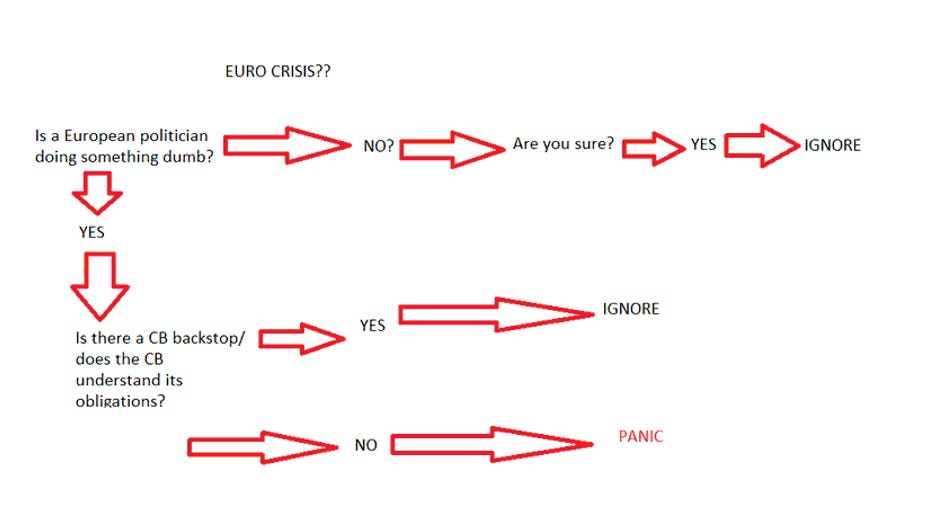

Monetary backstop, no crisis

Overall, it seems that there is some dry powder for a things to blow out, and if Le Pen wins implements crazy policies we could get the spark needed for crisis to blow out. The main counterargument against this view is the fact that ECB of 2024 is not ECB of 2010-2012. Simply, by having OMT and TPI programs at the ready, ECB can step in and prevent any crisis from getting out of hand. Dario Perkins created helpful flow chart suggesting that there is no reason to worry:

Dario is of course not suggesting that ECB will jump in at first sign of trouble, they would be crazy to do so. Just that they will jump in eventually, probably initially using TPI on bad days/weeks to try to break the market getting into panic mode. And if that does not work, then will use OMT to step in. Simply, this view is that ECB and policymakers more generally are not that dumb to allow another crisis. Or as Johannes Borgen put it: “if things go terribly south in France … the end game is not emergency powers or riots or even IMF, it's OMT and an ESM programme”.

Don’t rule out politicians doing dumb things

I am generally sympathetic to this view and I think it is much closer to truth than the doomster view. But I do not fully agree with it, because I think it is based on missing key aspect of the last eurozone crisis: it was a lot about politicians continuously doing dumb things. Or as I put it in terms of the key lesson from my course on financial crises, crises typically first need to get really bad so that politicians understand there is no other option than to change course and act.

Here, the key thing to realize is that while ECB will be more willing to act than in 2010-2012, and now has the tools to do so in effective way, it in my opinion does not mean it will act in all situations. The OMT program Johanes taunts as the end game is case in point: It has as a strict conditionality that given country requests a bailout, something the ECB would struggle to ignore. And that is the crux of the matter. Imagine Le Pen wins a majority, or that it governs with far left. One has to ask under what conditions, or even whether would Le Pen government request bailout? Afterall, requesting such bailout would be hugely costly to Le Pen, not to mention the conditions which would come with it.

Even much more centrists politicians were unwilling to go that way. Simply, politicians hate requesting bailouts and fulfilling its conditions. That much is clear from the first crisis: Ireland did request it only after ECB threaten to blow up the Irish banking system; Portugal only after government has fallen and new elections were called; and Spain refused requesting one and avoided doing so by getting a loan to its banking rescue fund instead, which is maybe telling how does “bailout” go down politicians throats in bigger countries.

One can point out that politicians always eventually do request bailout. Even the bailout-fighter Alexis Tsipras eventually did request the third one for Greece. That story, however, is if anything showing that things have to get really bad before politician from political fringe requests bailout, things have to get really, really bad. After all, it took 6 months of slow-motion bank run, and few weeks when people could not use credit cards, super low limits on amount of cash and drastic currency conversion controls to persuade Tsipras to fold and request the bailout Greek people just rejected in the referendum. And what good did it do him: Syriza tenure in power might forever be limited to the 4 years from 2015 to 2019, not something Le Pen would like to emulate.

Could ECB saved the day alone?

For me the takeaway is that while the end game is very likely ESM program and OMT intervention, that does not mean that we wont have euro zone crisis before that. Simply, to get to point where France officially requests ESM program we would need a world of pain, so that Le Pen finds requesting bailout better than not doing so. And that I don’t think would happen without

This leaves two ways of avoiding crisis. One, straightforward one, is avoiding any escalation to begin with. Simple way is for Le Pen not the win elections, or at least not so much to become the governing party. If it does, then avoiding escalation either means markets not taking fright about Le Pen government. Or Le Pen playing ball and not going to town with its policy plans and conformation with the European Commission.

There is of course one more option: ECB saving the day without cooperation with the politicians. In principle ECB has power to do that, given that eurozone crisis would be bad for policy transmission and ultimately for inflation outlook. And indeed, for exactly this readon ECB gave itself additional tool to protect transmission, the Transmission Protection Instrument. And while this also has fiscal cooperation as a condition for use, the wording is such that it clearly gives ECB freedom to act if it would want to regardless of whether French government would cooperate or not. And I think it is fair expectation that EBC would use TPI to keep the lid on spreads.

But would ECB be willing to do that? I am very hesitant to believe that could be the case, because that would get ECB very close to the realm of fiscal dominance (and possibly cross the legal limits). If things start getting bad they will surely intervene to some degree after the election is over. But if Le Pen goes crazy the intervention might be limited in size and/or limited to only some countries.[2]

From this perspective the summer of 2011 is instructive in this regards: back then ECB also had a tool how to calm down the markets, the SMP, and it actually did use it – to a limited degree. But it pretty much stopped as soon as Berlusconi stopped playing ball and started reneging on earlier fiscal promises. While the mindset is different now, they are clear echoes of that situation. For example, SMP also used fiscal operation from government as an argument for buying bonds, much like TPI formally does. And while the main lesson from the crisis was “don’t let things get out of hand”, another lesson the ECB policymakers are sure to remember is “when ECB acts, politicians stop acting”, outcome the ECB will try to avoid. After all ECB here will be playing a long game, knowing full well that if it lets Le Pen get off the hook for fiscally reckless plans, they will struggle to force government to ever deal with the fiscal situation.

In this regard I think the creation of OMT is a double edged sword. Its creation means that in there is a clear solution for when things start to get out of hand, which pretty much on its own was enough to stop the last crisis. But it also puts structure on intervening, one that requires cooperations of elected officials. This means that the more prudent members of governing council will point out that solution is at hand, and it is not up to them as unelected officials to do something if elected politicians are unwilling to do that. And remember, the context this time around will be different, with recent experience of very high inflation to keep ECB on tiptoes.

Crisis is tail event, but not impossible

Where does this leave us? I think anybody who has a sovererign debt crisis as the base scenario is deluding himself with their euro-doomerism. For us to go that way several things have to happen. It is not simply enough for Le Pen to win, even though that might lift spreads further. What would really need to happen is for Le Pen’s government to go to town on fiscal irresponsibility and conformation with European Commission. I am no expert on French politics, but my reading of the situation is that Le Pen’s ultimate goal is the presidency, and rocking the boat of French economy is not the best way to increase her chances of getting this goal. Not to mention that she will be severely limited in her power to do things by Macron being president and wielding veto over some agenda. My base case is for things to be bumpy for rest of this year, but for Le Pen to eventually find way of scoring political points without getting into outright fight with EC.

On the other hand, people who believe that it is simply impossible to have another sovereign debt crisis are in my opinion complacent. True, ECB and EC of today have very different outlook than ECB and EC of last decade, and the institutional architecture is also much improved. But that is just saying that to get a repeat of a crisis we would need something worse to happen, compared with what happened back then. But worse-things-than-before happen all the time, and in many ways the current situation already is worse: we have Meloni and Le Pen instead of Berlusconi and Holland.

[1] More extreme version of this view is arguing that ECB is keeping spreads artificially suppressed and not reflective of fundamentals by first doing QE for 8 years, and now by doing somewhat selective reinvestments. Of course, this more extreme view is hard to square with the simple facts that spreads did not have magically lower during first 5 years of QE; and that since QE started we had multiple localized blow out in spreads, from first Le Pen scare in run up to the 2017 presidential elections, to reaction to new government’s plans in Italy in 2018.

[2] Limiting it to Greece, Portugal and Spain would be the easy option. The problem is Italy – given its gigantic debt and deficit, ECB would struggle to justify intervening in Italy but not France. One way to achieve that is by Meloni playing nice and distancing Italy from France in terms of fiscal plans.